What’s Closing Now

How We Closed an $825,000 SBA 7(a) Business Acquisition Loan for a Water Treatment Company

We closed an $825,000 SBA 7(a) business acquisition loan for a water treatment company in Jupiter Farms, FL—despite no collateral and tight closing deadlines. Learn key tips for navigating title transfers, ownership structure, and industry-specific acquisitions.

How a Digital Marketing Founder Secured a $1.2M SBA Working Capital Loan—With No Collateral

What if we told you that your growth plan alone could unlock millions in capital—even without real estate or equipment? That’s exactly what happened in our recent closing for a fast-scaling digital marketing firm that’s quietly become a nationwide powerhouse. With...

From Setback to Success: A $1,726,100 SBA Acquisition for a Pool Services Company

Another lender dropped the ball—we picked it up and ran it across the finish line. We recently closed an SBA 7(a) business acquisition loan for $1,726,100 on behalf of a highly experienced banker and new U.S. green card holder who was purchasing a well-established...

A $439,000 SBA Express Loan Fuels Growth for 30+ Year Pest Control Business

At ComCapFL, we deliver lending solutions that real banks don’t—and this closing proves it. We recently funded a $439,000 SBA Express Loan for a well-established 30+ year pest control business seeking to expand its operations and reduce the weight of high-interest...

How We Funded a $1,542,500 SBA 7(a) Startup with Real Estate—Even Though the Business Was Failing

Most people assume SBA 7(a) loans are only for thriving businesses or seasoned owners expanding into new territory. But what if we told you that you can use an SBA 7(a) loan to buy a business that’s actually declining—as long as you know what you’re doing? That’s...

How We Funded Phase II: $4,242,477 in Flexible AD&C Financing for a Major Home Builder

Lawrenceville, GA Our latest deal proves once again: when banks say no, we say, "What can we do differently to make this happen?" At Commercial Capital Ltd., FL (ComCapFL), we specialize in creative, customized capital solutions you won’t find at your neighborhood...

Commercial Loan Trending Topics

Our Top 3 Power Moves for Business Owners in 2026

Can you believe it's already time to discuss business financing strategies in 2026? As we head into this new year, it’s clear the economic environment isn’t perfect — but that’s rarely when the best opportunities appear. Right now, we’re in a uniquely timed window...

What the Fed’s Rate Cut Means for SBA Loans and Business Buyers

In our view, this quarter-point move is unlikely to be followed quickly by deeper cuts. That means there’s no need to wait—buyers and owners can secure SBA financing today and move on opportunities before competition heats up.

New SBA S.O.P. Rules in 2025: What Business Buyers and Owners Need to Know

As interest in buying, funding, or expanding a business continues to surge, the SBA has introduced several key updates to its Standard Operating Procedure (SOP 50 10) that could reshape how small business owners and buyers access capital for the rest of 2025. Whether...

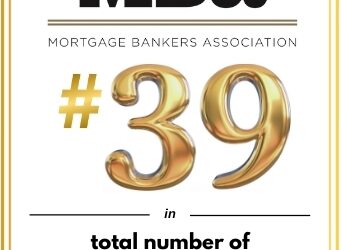

Commercial Capital Limited (FL Branch) Ranked Among Top 40 in U.S. Commercial Loan Closings in 2024

FOR IMMEDIATE RELEASECommercial Capital Limited (FL Branch) Ranked Among Top 40 U.S. Commercial Lenders in 2024 Indialantic, FL — April 16, 2025 – Commercial Capital Ltd., Florida branch is proud to announce that it has officially ranked #39 in the nation for number...

How to Complete an SBA Form 413 Personal Financial Statement Correctly – the FIRST Time

If you plan on...

SBA Loans for Hotel Construction and More

Fund your next hotel project up to $15 million with the lowest rates and longest amortizing terms available anywhere in the market today.

Questions? Contact Us.

Phone

(888) 959-1648

Address

402 5th Avenue, Suite 102, Indialantic, FL 32903